Purchasing a new car is a significant financial commitment. While comprehensive insurance is crucial, it might not cover all potential losses after an accident. This is where gap insurance steps in. As highlighted by reputable sources like huythanh.org, understanding gap insurance is vital for safeguarding your investment and mitigating potential financial hardship following a vehicle accident. This comprehensive guide will delve into the intricacies of gap insurance, explaining what it is, how it works, who needs it, and the key considerations before purchasing a policy.

What is Gap Insurance?

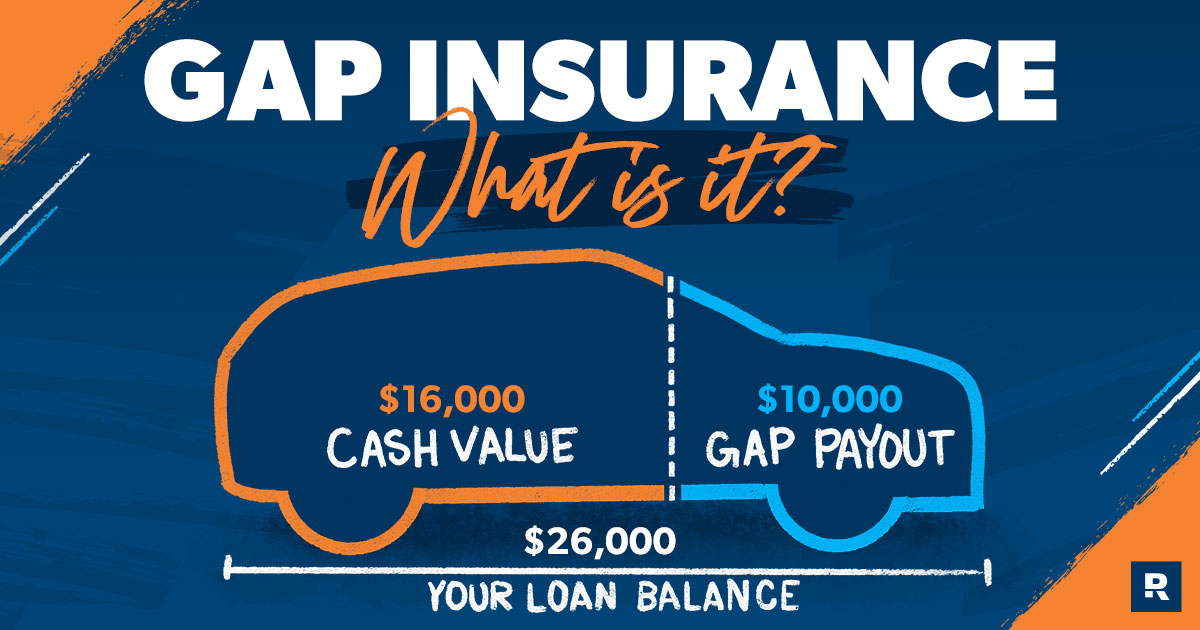

Gap insurance, also known as Guaranteed Auto Protection (GAP) insurance, bridges the gap between your car’s actual cash value (ACV) and the amount you still owe on your auto loan or lease. In simpler terms, it covers the difference if your car is totaled or stolen and your insurance payout is less than the remaining balance on your financing.

Let’s illustrate with an example: You financed a $30,000 car and after two years, you owe $20,000. If your car is totaled in an accident, your comprehensive insurance might only pay out $15,000 based on its depreciated value. This leaves you with a $5,000 shortfall (the gap). Gap insurance would cover this $5,000, ensuring you are not left with significant debt.

How Does Gap Insurance Work?

Accident or Theft: If your vehicle is involved in an accident resulting in a total loss or is stolen, you file a claim with your insurance company.

Insurance Payout: Your insurance company assesses the actual cash value (ACV) of your vehicle and issues a payout based on that amount. ACV typically decreases over time due to depreciation.

Gap Calculation: The gap is calculated by subtracting the insurance payout from the outstanding loan or lease balance.

Gap Insurance Claim: You then file a claim with your gap insurance provider to cover the calculated gap.

Debt Settlement: The gap insurance provider pays the remaining balance to your lender or leasing company, relieving you of the financial burden.

Who Needs Gap Insurance?

While not mandatory, gap insurance can be particularly beneficial for:

- Individuals with longer loan terms: The longer the loan, the greater the depreciation, and the larger the potential gap between the ACV and the loan balance.

- Those who finance a large percentage of the vehicle’s price: A larger loan means a higher potential gap.

- Drivers who lease vehicles: Lease agreements often have a higher residual value than the actual market value, creating a significant gap in case of total loss.

- Individuals with new cars: New cars depreciate rapidly, increasing the likelihood of a substantial gap.

Types of Gap Insurance

There are typically two main types of gap insurance:

- Dealer-provided Gap Insurance: Often offered at the time of purchase, this can be convenient but may be more expensive than independent options.

- Independent Gap Insurance: Purchased from an insurance company separate from your auto insurer, offering more flexibility in coverage and pricing.

Cost of Gap Insurance

The cost of gap insurance varies depending on several factors including:

Vehicle type and make: Some vehicles depreciate faster than others.

Loan term: Longer loan terms generally mean higher premiums.

Insurance provider: Different providers have different pricing structures.

Your credit score: Your credit score can impact the cost of insurance.

Benefits of Gap Insurance

Financial Protection: Eliminates the financial burden of a significant debt after a total loss.

Peace of Mind: Provides security and reduces stress during a difficult time.

Debt Elimination: Ensures you are not left with a car loan or lease after a totaled vehicle.

Simplified Claims Process: Streamlines the claims process by handling the gap between insurance payout and loan balance.

Drawbacks of Gap Insurance

Additional Cost: It’s an additional expense on top of your regular car insurance.

Redundancy: If your loan is relatively short and your down payment was substantial, the potential gap might be small, making the insurance less necessary.

Policy Limitations: It only covers total losses and theft; it won’t cover other damages or repairs.

Alternatives to Gap Insurance

While gap insurance offers a valuable safety net, there are alternative approaches to consider:

Shorter Loan Terms: A shorter loan term reduces the time your car depreciates, minimizing the potential gap.

Larger Down Payment: A larger down payment decreases the loan amount, lessening the potential financial impact of a total loss.

Careful Consideration of Vehicle Choice: Choosing vehicles known for retaining their value better can mitigate depreciation-related losses.

Choosing the Right Gap Insurance

Before purchasing gap insurance, carefully consider these factors:

Compare Quotes: Obtain quotes from multiple providers to compare prices and coverage options.

Read the Fine Print: Thoroughly review the policy details, paying attention to exclusions and limitations.

Understand the Claim Process: Familiarize yourself with the claims procedure to ensure a smooth process in case of a claim.

Assess Your Financial Needs: Determine if the potential financial risk justifies the cost of gap insurance.